Archive for the ‘media’ Category

On Mark Bowden’s NYT takedown

The so-called crisis in the news industry sure has generated some sensational stories of late. “American journalism is in a period of terror,” announces Mark Bowden in a tome of an article appearing in the May issue of Vanity Fair. Mostly a deft hatchet job on Arthur Sulzberger Jr., the publisher of the New York Times, Bowden’s piece sent the media cognoscenti into a tizzy, although nobody seems to have noticed its one truly illuminating segment.

Photo illustration from Vanity Fair.

Even the mighty Times is facing financial peril these days, and Bowden’s premise is that the newspaper scion “has steered his inheritance into a ditch.” He abuses tools of the trade to help suggest his case. As one unnamed “industry analyst” tells us, “Arthur has made some bad decisions, but so has everyone else in the business. Nobody has figured out what to do.” Earth shattering. Perhaps Bowden should pick up a copy of the Times and read Clark Hoyt on the suitable use of anonymous sources. For a substantive take on contemporary debacles across the business, check out this recent piece by Daniel Gross.

In fact, I’m a big fan of Bowden’s. Right now I happen to be reading his 2006 book “Guests of the Ayatollah,” a riveting account of the Iran hostage crisis. Particularly in the realm of national security, few reporters are as exhaustive, persuasive — and downright exciting to read — as him.

On the media, not so much. There he has tended toward the self-involved, maybe a particular pitfall for great reporters covering their own vocation. (See the opening line of the Sulzberger article, which zooms in directly on… Bowden himself, as he receives a phone call from Sulzberger: “I was in a taxi on a wet winter day in Manhattan three years ago…” Especially telling, I think, given that in another recent piece orbiting the news business, a profile of David Simon, Bowden also wrote himself prominently into the narrative.) The Vanity Fair article is exquisitely timed with the accelerating upheaval in the newspaper industry, and reads mostly like, well, a salacious, insider-y Vanity Fair article.

And yet, buried deep in the 11,500 words is one of the best analogies I’ve encountered anywhere conveying the potential for digital journalism:

When the motion-picture camera was invented, many early filmmakers simply recorded stage plays, as if the camera’s value was just to preserve the theatrical performance and enlarge its audience. To be sure, this alone was a significant change. But the true pioneers realized that the camera was more revolutionary than that. It freed them from the confines of a theater. Audiences could be transported anywhere. To tell stories with pictures, and then with sound, directors developed a whole new language, using lighting and camera angles, close-ups and panoramas, to heighten drama and suspense. They could make an audience laugh by speeding up the action, or make it cry or quake by slowing it down. In short, the motion-picture camera was an entirely new tool for storytelling.

Bowden uses the comparison in the service of whacking Sulzberger — but it also points directly to a broader stagnation in media companies’ use of the digital platform. There is experimentation going on, but often without much imagination: Digital video clips are all the rage? OK, we’ll put reporters on camera describing the stories they’ve just published! Online communities and reader interactivity are the latest buzz? OK, we’ll feature the shouting matches in our comments threads as actual news!

The rising multimedia and publishing capabilities of the digital realm are charged with promise, and demand deeper thinking about their optimal use. With any given subject, which digital tools are most effective for gathering information and telling the story? How can the information-rich ecosystem of the Web enhance the knowledge gained? What new ways are there to produce reliable, authoritative and compelling content, taking maximum advantage of a decentralized and participatory technology like no other we’ve ever known?

Soon enough we may all be getting our news on a kind of flexible digital paper. The possibilities for what it could contain are big, and they’re just beginning.

UPDATE: Mark Bowden responds.

Guardian’s Twitter move, GM’s bailout madness

It’s adding up to a strange day in the news, my friends, but then again these are no ordinary times.

The venerable 188-year-old Guardian, apparently seeing the ugly writing on the wall for the media business, has taken perhaps the boldest step yet to embrace digital technology. Will such an all-in bet on rapid-fire reporting pay off?

Meanwhile, in the heart of Silicon Valley, a hotshot entrepreneur has moved to capitalize on social networking technology in a different cutting-edge way. If the producers of “The Bachelor” take notice, look out for a full convergence of reality TV and the Internets even sooner than already anticipated.

Meanwhile, in the heart of Silicon Valley, a hotshot entrepreneur has moved to capitalize on social networking technology in a different cutting-edge way. If the producers of “The Bachelor” take notice, look out for a full convergence of reality TV and the Internets even sooner than already anticipated.

And in what can only really be considered a desperate move, General Motors apparently is grasping for a solution to its epic troubles by way of two well-known, if irritating, car experts.

More odd stuff going on across the pond.

The month the news broke

It may be that we’ll look back at March 2009 as a pivotal time in the erratic but inexorable transition from print to digital news. In some ways it’s very much a slow-motion revolution, beginning perhaps as long ago as 1981, and far from over. But this month has been striking both for the destruction in the newspaper industry and the hum of activity focused on the digital future.

It’s the latter that matters more. NYU media maven Jay Rosen has pulled together an essential roundup for anyone interested in diving deep into the discussion. Rosen credits a March 13 essay by Clay Shirky with triggering a flurry of writing; he summarizes a dozen recent pieces that build out the picture. I haven’t read them all yet, but in addition to Shirky’s piece I highly recommend Steven Berlin Johnson’s Old Growth Media and the Future of News, which he presented at the South By Southwest Interactive Festival in Austin. His use of ecosystems as a metaphor for the digital transformation is enlightening in multiple ways, while smartly avoiding utopianism:

It’s the latter that matters more. NYU media maven Jay Rosen has pulled together an essential roundup for anyone interested in diving deep into the discussion. Rosen credits a March 13 essay by Clay Shirky with triggering a flurry of writing; he summarizes a dozen recent pieces that build out the picture. I haven’t read them all yet, but in addition to Shirky’s piece I highly recommend Steven Berlin Johnson’s Old Growth Media and the Future of News, which he presented at the South By Southwest Interactive Festival in Austin. His use of ecosystems as a metaphor for the digital transformation is enlightening in multiple ways, while smartly avoiding utopianism:

Now there’s one objection to this ecosystems view of news that I take very seriously. It is far more complicated to navigate this new world than it is to sit down with your morning paper. There are vastly more options to choose from, and of course, there’s more noise now. For every Ars Technica there are a dozen lame rumor sites that just make things up with no accountability whatsoever. I’m confident that I get far more useful information from the new ecosystem than I did from traditional media a long fifteen years ago, but I pride myself on being a very savvy information navigator. Can we expect the general public to navigate the new ecosystem with the same skill and discretion?

Indeed, as Johnson suggests, information consumers may yet crave the guidance of authoritative institutions, including… newspapers. Some of which now command some of the largest online audiences. But many of them have been failing in the vision department, as Alan Mutter pointed out early this month:

As a direct consequence of the breakdown in the traditional media business model, publishers today are cutting the quality and quantity of the content they produce at the very moment they should be investing more aggressively than ever … As the most challenged of all the distressed media companies, newspapers are so strapped today that they are producing ever less original reporting … This is not merely a step in the wrong direction. It is a leap into the abyss.

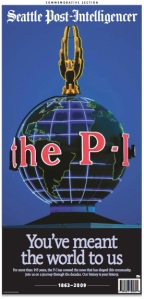

As the fresh experiment with The P-I in Seattle seems to indicate so far, taking a newspaper all-digital while cutting its news gathering capacity by roughly 80 percent is not a great way to proceed.

While there is still plenty of handwringing going on, in my view the essays gathered by Rosen evoke daybreak far more than twilight. And March 2009 is ending on a bright note, at least symbolically. Ever since its election-year rise, the opinion-laden Huffington Post has been touted as a model for future journalism — never mind that it doesn’t pay most contributors and produces almost zero original reporting. Late yesterday the publication announced a new turn: the launch of a $1.75 million investigative reporting initiative.

Is AIG evil? Let’s hear from the people!

At hearings Wednesday on Capitol Hill lawmakers excelled at one of the things they do best: political theater. The outrage flowed, as Edward Liddy, the current CEO of American International Group, got grilled about the $165 million in bonuses going to a bunch of guys who helped bring the U.S. banking sector to the brink of collapse with immense and immensely reckless insurance bets. (A complicated scheme, but credit to President Obama, who did a decent job Wednesday morning of explaining in basic terms how they did it.)

To what degree Americans should be angry at taxpayer-backed AIG or our government leaders (past and present) is a murky discussion, but it’s clear that the level of outrage across the country is plenty high right now. (High enough not only to juice a show on Capitol Hill, but also some widely celebrated media blood sport.) What’s interesting to me at the moment is how a number of major news outlets have seen the popular discontent as an opportunity to highlight reader interactivity on the Web.

At the top of its home page Tuesday night the New York Times featured reader diatribes — treating them as news itself. “Some people are vengeful, calling for jail, public humiliation or even revolution,” reported A.G. Sulzberger. Over the last few days, “the most passionate voices, not surprisingly, could be found on the Internet — on blogs and discussion threads — in unusually bountiful numbers.”

On Wednesday afternoon, the Washington Post featured a round-up of its own reader comments, if not especially articulate or enlightening. (“Corporate and political self-seeking are devastating our families, our country, and out [sic] world.” Etc.) The Wall Street Journal’s home page gave top real estate to voices from the “Journal Community,” which tended, naturally, to reflect a constituency of a somewhat different kind. “The Obama administration is spending too much time and resources to go after this money,” scolded reader Craig Cohen. “The fact is, it will probably cost the US more money in legislative time, attorney fees, opportunity cost, etc to get these bonuses back than they are worth. But that doesn’t matter to the President. This is not about bonuses. It’s about class warfare. These bonuses went to the elite…. They must be punished!”

A key question on my mind is, how can media companies unlock greater potential with reader engagement and participation? It’s stating the obvious to say that there’s nothing cutting-edge at this point about letting readers loose with their opinions. (Put nicely, it tends to have limited value in unfiltered form.) Are there new ways to generate useful insight and information from the many smart readers out there, rather than just a lot of noise? This is an issue we grappled with regularly over the years when I was at Salon, and I have a hunch it could figure prominently in ways forward with news reporting in the rising digital realm. What if, for example, readers with experience in the culture of Wall Street could begin to add to the picture of how the AIG problem metastasized? Or shed light on how thoroughly it has been reported on?

Smart people have been working on ideas in this area for some time. Mother Jones has an interesting activist-style approach that it’s experimenting with. Between the ongoing destruction in the newspaper industry and what some major companies are attempting now online in terms of reader interactivity (the two hardly unrelated), I have the sense that whoever begins to unlock the challenge in a more creative, substantive way could make a big splash.

The revolution will be further digitized

A large newspaper in a major American city has just gone all-digital. Depending on how you choose to look at it, the occasion is either tragic or revolutionary.

The 146-year-old Seattle Post-Intelligencer printed its last edition on Tuesday, becoming an Internet-only news source. In a report on its own Web site, the “paper” described the contours of the new, much smaller operation now in place. The P-I, as it’s called, is a “community platform” that will feature “breaking news, columns from prominent Seattle residents, community databases, photo galleries, 150 citizen bloggers and links to other journalistic outlets.” The New York Times notes that The P-I “will resemble a local Huffington Post more than a traditional newspaper,” with a news staff of about 20 people rather than the 165 it had, and with an emphasis more on commentary, advice and links to other sites than on original reporting.

The 146-year-old Seattle Post-Intelligencer printed its last edition on Tuesday, becoming an Internet-only news source. In a report on its own Web site, the “paper” described the contours of the new, much smaller operation now in place. The P-I, as it’s called, is a “community platform” that will feature “breaking news, columns from prominent Seattle residents, community databases, photo galleries, 150 citizen bloggers and links to other journalistic outlets.” The New York Times notes that The P-I “will resemble a local Huffington Post more than a traditional newspaper,” with a news staff of about 20 people rather than the 165 it had, and with an emphasis more on commentary, advice and links to other sites than on original reporting.

The P-I venture may well fail — but in an essential way, that’s a good thing. Why that’s the case is explained in an indispensable essay posted by media-technology thinker Clay Shirky a few days ago. Glancing as far back as the 16th-century advent of the printing press, Shirky’s piece is an illuminating synthesis of the industry’s past and present — and, from where I’m sitting, brims with aphoristic insights pointing to a bright future for digital journalism. Original reporting in that realm — still much underdeveloped and ripe for innovation, in my view — will play a vital role in the further transformation.

Shirky writes: “People committed to saving newspapers [keep] demanding to know ‘If the old model is broken, what will work in its place?’ To which the answer is: Nothing. Nothing will work. There is no general model for newspapers to replace the one the internet just broke.”

To the old journalism guard, that’s a heartbreaking epilogue. Which of course misses the point. (Revolutions create a curious inversion of perception, Shirky notes.) “With the old economics destroyed, organizational forms perfected for industrial production have to be replaced with structures optimized for digital data,” he continues. “It makes increasingly less sense even to talk about a publishing industry, because the core problem publishing solves — the incredible difficulty, complexity, and expense of making something available to the public — has stopped being a problem.”

Revolution is a dramatic word, but it’s exactly what we’re witnessing, if in slow motion. It began a little more than a decade ago and perhaps will require another decade before reaching a level of maturity and stability with new form. Shirky describes the familiar process: “The old stuff gets broken faster than the new stuff is put in its place. The importance of any given experiment isn’t apparent at the moment it appears; big changes stall, small changes spread. Even the revolutionaries can’t predict what will happen.”

(On recognizing “the importance of any given experiment,” see Shirky’s great distillation of the rise of Craigslist. Experiments are only revealed in retrospect to be turning points, he observes. And regarding “big changes stall” — the fashionable HuffPo model, anyone? With all due respect and admiration for its achievements during an epic election year, who really believes HuffPo’s almost-zero-reporting approach is the future of journalism?)

On with the greater experimentation and innovation, then. Many new attempts like The P-I probably will fail, and, in effect, we need them too. “There is one possible answer,” Shirky says, “to the question ‘If the old model is broken, what will work in its place?’ The answer is: Nothing will work, but everything might.”

About that big Jim Cramer beatdown

Jon Stewart is getting showered with praise for his showdown with CNBC’s Jim Cramer Thursday night on “The Daily Show.” The culmination of a week-long “feud” (egged on by the salivating media at large) was riveting to watch. (The video is here.) Stewart, long a savvy media critic, brutalized Cramer both for his own and the financial news network’s direct role in the economic meltdown that has vaporized untold wealth and hobbled the United States of America.

If that sounds a tad overdone, well, indeed. There is plenty of truthiness in Stewart’s point. It’s easy to sift through footage from various CNBC shows and find no shortage of their hosts making wrong calls about the financial markets, cheering on suspect CEOs and exuding what in hindsight was obviously misguided optimism about the economy and the stock market. Not to mention analyst Rick Santelli’s puerile, faux-populist tirade last month about the mortgage crisis.

But there is also some intellectual dishonesty suffusing the big CNBC takedown so in vogue right now. It’s easy to level simplistic snark at the network per above. But few seem willing, Stewart included, to acknowledge what the popular financial news network is mostly about, as I wrote about here recently: daily infotainment, emphasis on tainment.

Let’s be honest, we’re all plenty hungry at present for the villains of Wall Street to be strung up in the town square. But blame-the-media is the easy way out. It’s a bit silly to assign the degree of culpability that Stewart just did to a guy who, on his daily stock picking show, bounces around detonating obnoxious sound effects and exclaiming “Booyah!” like a frat guy on meth.

Stewart has other smart thinkers in the media following right along. David Brancaccio, host and senior editor of “Now on PBS,” told CNN that Thursday night’s show marked an important moment in journalism, especially for financial reporting, and that it may serve as a cautionary tale for those in the media who would fail on due diligence. “I don’t think any financial journalist wants to be in Cramer’s position,” Brancaccio said. “I think [journalists] may redouble their efforts to be dispassionate reporters asking the tough questions.”

That’s just goofy. Jim Cramer is not a financial journalist. He’s a self-cultivated nut-job host of a popular sideshow for Wall Street wonks. His script brims with speculative investment ideas, clumsy jokes and useless if marginally entertaining financial prattle.

The truth of the matter is that while CNBC certainly is ripe to take some lumps in this new era of Great Recession, the network is the easiest of targets. It’s also worth noting that there is substantive reporting in its mix. Last month, in fact, I spent some time interviewing CNBC anchor Maria Bartiromo and correspondent Bob Pisani at the New York Stock Exchange for a forthcoming magazine article about the financial media. Mostly I found them to be informed, thoughtful and dedicated to their work as reporters. For one example, see the high marks Bartiromo got for grilling ex-Merrill Lynch CEO John Thain on her show back in January. For another, watch this recent Frontline documentary, which recounts how in spring 2008 CNBC reporter David Faber helped pull the curtain back on Bear Stearns and impacted the timing of the investment bank’s collapse.

No doubt they and others on the network also had craven moments of their own during the boom times. As did so many in American government, business and, yes, out there in TV-viewing land. A dramatic and bloody round of the blame game is quite satisfying to watch right now, especially in the able hands of Mr. Stewart, but the culpability for our economic predicament extends far, far beyond the spectacle of one television channel.

This just in: No newspaper at all

More American newspapers appear to be accelerating toward demise. For anyone who’s been paying attention to the industry, it’s been clear at least since last fall that 2009 would be a year of considerable destruction. Take the spreading flame of digital technology, pour on a vicious economic downturn and quickly you have a raging forest fire. In the New York Times today Richard Pérez-Peña reports on which U.S. cities soon might not have a major daily print paper at all. Perhaps it’ll be Seattle or Denver. Or maybe San Francisco. Just a short while ago the prospect would’ve been inconceivable.

I like the forest fire metaphor here because it suggests an essential part of the picture that in many quarters still isn’t getting its proper due: The fertile rebirth that follows the destruction. I’ve been surprised to see a degree of pessimism even from some who’ve already been toiling on the frontier:

“It would be a terrible thing for any city for the dominant paper to go under, because that’s who does the bulk of the serious reporting,” says Joel Kramer, the editor and CEO of Minneapolis-based MinnPost.com, in the Times today. (Kramer was formerly editor and publisher of The Star Tribune.) “Places like us would spring up, but they wouldn’t be nearly as big. We can tweak the papers and compete with them, but we can’t replace them.”

“It would be a terrible thing for any city for the dominant paper to go under, because that’s who does the bulk of the serious reporting,” says Joel Kramer, the editor and CEO of Minneapolis-based MinnPost.com, in the Times today. (Kramer was formerly editor and publisher of The Star Tribune.) “Places like us would spring up, but they wouldn’t be nearly as big. We can tweak the papers and compete with them, but we can’t replace them.”

Really? There’s a tendency to equate the withering of the old medium (newsprint) with the demise of what it has delivered (news reporting). But increasingly it’s going to be delivered digitally. If the old media companies don’t do it, others will, because the demand (and therefore market) for it is undeniable. Sooner than we probably realize, we’re all going to be walking around carrying some kind of digital newspaper in our hands. Organizations will arise and mobilize to provide the reporting in it. And people will pay for it. (Businesses are also likely to advertise around it.)

Indeed, formidable challenges remain to working out viable business models. But the field is increasingly wide open and waiting to be seeded. (New tracts soon available!—see above.) You can look at the crisis as a tragedy, or you can look at it as an opportunity.

As Pérez-Peña notes, the Washington Post had a newsroom of more than 900 people six years ago, with fewer than 700 now. The LA Times newsroom is half the size it was in the 1990s, with a staff of about 600 today.

Call me crazy, but that’s still an awful lot of resources with which to gather and produce stories. Without the major printing and distribution costs of their antique brethren, digital ventures still will probably need to be considerably smaller and more nimble to succeed. (In the near-term economy, at least.) Even if some early experiments haven’t been so impressive, my sense is that those who survive and thrive will do so especially via robust local and regional reporting, fast dwindling in many places now. (Apparently the LA Times has some other strategy in mind.)

Self-described “newsosaur” Alan Mutter offers some intriguing advice for those who reportedly may launch the first digital-only newspaper in a major U.S. city, from the ashes of the Seattle Post-Intelligencer. “Be different” and “cop an attitude,” he suggests. “Think of the site as more of a blog than a newspaper.”

Hmm, it seems there’s no shortage of that to go around… but I like his closing thoughts: “The work you do will play a major role in helping to define the future – and the future economics – of local news coverage. Take risks, try everything and have fun. Whatever you do, don’t look back.”

The future of Internet news, circa 1981

This ancient clip from a local San Francisco broadcast has been floating around for a while, but it keeps popping up in discussions about the fate of the newspaper industry, so I couldn’t resist. It’s pretty priceless viewing if you haven’t seen it.

And not just because it’s hilariously antique — it’s also a prelude to a cautionary tale. Believe it or not, the San Francisco Examiner was once working on the cutting edge of the Internet. The Examiner’s David Cole certainly intended no irony when interviewed then about their “electronic newspaper” experiment: “We’re trying to figure out what it’s going to mean to us as editors and reporters and what it means to the home user. And we’re not in it to make money. We’re probably not going to lose a lot, but we aren’t going to make much, either.”

Online media pioneer Scott Rosenberg (at the Examiner himself back in the 1980s and a mentor of mine at Salon in the early 2000s) wrote insightfully about this clip a few weeks back, and how far the newspaper industry hasn’t come:

The spirit of experimentation that the Examiner set out with in 1981 dried up, replaced by an industry-wide allergy to fundamental change. “Let’s use the new technology,” editors and executives would say, “but let’s not let the technology change our profession or our industry.” They largely succeeded in resisting change. Now it’s catching up with them.

That’s probably putting it lightly, considering the current state of the San Francisco Chronicle (a participant in the 1981 “experiment”), the Seattle Post-Intelligencer, the Rocky Mountain News and so many others.

Today, a heartfelt eulogy from Nancy Mitchell, a former reporter for the freshly defunct Rocky, carries its own layer of irony. Mitchell’s sentiments are genuine and noble, and certainly appreciated by this fellow newspaper fan and ardent believer in the value of quality reporting.

But Mitchell falls yet into the trap described above — denial of inexorable industry transformation, and a failure of imagination. She blames faceless management types at the Rocky for attempting foolish or half-baked ways to recast the paper in a time of dramatic change. (No doubt they did.) She quietly denigrates experimentation with digital tools like blogs, Flickr and Twitter, as if nobody interested in serious journalism should have to deal with “the anxiety attached to learning the gimmicks.” She seeks shelter in a credo once posted in her managing editor’s office: “Three simple rules, not produced by a focus group: Get the news. Tell the truth. Don’t be dull. I’d like to believe we did all three.”

What Mitchell doesn’t seem to realize is that all three — and more — increasingly can and will be done digitally. The audience will be there to engage with it. Business models will arise to support it. Technology will keep transforming it. It seems obvious to say it’s the way the world is fast going, whether with reporting, commentary or many other information-based creations. Just note where her piece was published, of course, and how you’re encountering it right now.

Putting lipstick on a bear

The Dow Jones average is swimming down around 6,800 today, hitting a new 12-year low. If in a basic sense the stock market represents a rough overall valuation of the U.S. economy, then the U.S. economy is now worth less than it was in April of 1997. Whether that’s realistic I have no idea, but either way it seems a rather stunning measure.

In recent days, by way of working on a forthcoming magazine article, I’ve been taking in a sizable dose of CNBC, the ubiquitous financial news network. The channel is watched obsessively by most on Wall Street (I saw this firsthand on a recent reporting trip to the New York Stock Exchange and surrounds), and its constant chatter can be found in airport lounges, urban corner stores and no doubt the many living rooms of America’s investor class. The personalities hosting CNBC’s various shows do produce substantive reporting on the financial world daily, but much of the air time is filled with infotainment, emphasis on tainment. In addition to the usual stream of industry banter and speculative investing ideas, these days there’s no shortage of finger-pointing commentary about the policy maneuvers of the Obama administration.

Still, you can’t run a popular cable network on a steady drip of downer, so today the hosts of CNBC’s “Power Lunch” have been trying their darn best to dress up another ugly day on Wall Street. Courtesy of their “smart strategies special,” cue the segment: Three ways to make money in value stocks!

“Apparently there are more value stocks out there than ever,” announces Sue Herera, preparing to welcome two money managers who’ll offer favored picks.

“Value stocks are being created right now,” declares a smiling Bill Griffith, glancing sidelong at the sinking averages.

Good luck, folks. As James Grant noted in a sobering roundup of financial experts in yesterday’s Times, the truth about vicious bear markets is that they end when investors finally give up hope. “Hope sustains life,” Grant writes, “but misplaced hope prolongs recessions.”

A reality check for the recovery plan haters

It doesn’t seem particularly out of the ordinary when Rush Limbaugh looks at Obama’s economic recovery plan and reiterates his desire to see the president fail. Or when Gov. Bobby Jindal, purportedly the rising star of the Republican Party, argues that federal spending is a bad way to pull the nation back from the brink. But these are no ordinary times — faced with the greatest domestic crisis in modern memory, at what point does hard-line politics make for sheer lunacy?

While reporting for a forthcoming magazine piece, I spoke recently with economist Dean Baker about some of the political right’s machinations regarding the economic meltdown.

“One thing that was amazing to me was people blaming the housing crisis on the Community Reinvestment Act. It makes no sense whatsoever,” said Baker, who is co-director of the Center for Economic and Policy Research in Washington. “The idea was widely circulated, so there are a lot of people out there who believe that what lies at the center of the crisis is that the government forced banks to make loans to poor people and minorities. That’s absurd, and the media should’ve been doing more to point that out.”

A few did, at least: Businessweek’s Aaron Pressman explained last fall why the 1977 federal law, requiring banks to lend in low-income neighborhoods where they take deposits, had little to do with the insidious subprime mortgages that inflated the housing bubble. (Pressman further pointed out that the Bush government in fact weakened the CRA, while enabling Wall Street to gorge on dubious derivatives and absurd leverage.) But the blame game holds powerful emotional appeal in dark days, and the warriors of the right soldier on in earnest.  Fox News’ Sean Hannity keeps repeating a debunked GOP talking point that the freshly signed $787 billion recovery package contains a $30 million provision to save a salt marsh mouse in San Francisco. Simply erroneous, as Congressman Joe Sestak pointed out this week on Hannity’s own show. (Here’s the video.)

Fox News’ Sean Hannity keeps repeating a debunked GOP talking point that the freshly signed $787 billion recovery package contains a $30 million provision to save a salt marsh mouse in San Francisco. Simply erroneous, as Congressman Joe Sestak pointed out this week on Hannity’s own show. (Here’s the video.)

Baker worries that partisan warfare will squelch political appetite for additional stimulus — which he believes will be necessary going forward. Obama had to fight hard just to get the first big spending plan through Congress. “Nobody wants to waste money,” Baker said, pointing out that job creation and a particular project’s usefulness are different issues. “But if the alternative is that people think we’re somehow going to benefit by not spending money, then they’re just on another planet.” Without more government spending to come, he said, “we could see this downward spiral continue for some time.”

California notebook: New highs, new lows

San Francisco’s Tom Ammiano, a former city supervisor turned state assemblyman, wants to go green to help bail out the state from fiscal crisis. His plan would boost weed farms not wind farms. He introduced a bill Monday to legalize recreational marijuana and regulate it in a manner similar to alcohol, with a potential tax windfall of more than $1 billion. (The fragrant green stuff is thought to be a $14 billion cash crop in the state. Then there’s the potential savings in law enforcement costs in the hundreds of millions.) Not likely to fly, despite California’s reputation for cutting-edge policy and a devastating $42 billion deficit. But credit the San Francisco maverick for thinking creatively in a time of crisis. And credit the political opposition with the Most Mangled Cliché Award — said Calvina Fay, executive director of Save Our Society From Drugs, in the LA Times: “This would open another door in Pandora’s box.” (What’s she been smokin’?)

San Francisco’s Tom Ammiano, a former city supervisor turned state assemblyman, wants to go green to help bail out the state from fiscal crisis. His plan would boost weed farms not wind farms. He introduced a bill Monday to legalize recreational marijuana and regulate it in a manner similar to alcohol, with a potential tax windfall of more than $1 billion. (The fragrant green stuff is thought to be a $14 billion cash crop in the state. Then there’s the potential savings in law enforcement costs in the hundreds of millions.) Not likely to fly, despite California’s reputation for cutting-edge policy and a devastating $42 billion deficit. But credit the San Francisco maverick for thinking creatively in a time of crisis. And credit the political opposition with the Most Mangled Cliché Award — said Calvina Fay, executive director of Save Our Society From Drugs, in the LA Times: “This would open another door in Pandora’s box.” (What’s she been smokin’?)

•

It’s been raining in the Bay Area for almost a week straight, happy news after a bone-dry January. But 2009 is on track for a third straight year of drought in California, with reservoirs still sitting at alarmingly low levels. It’s not just the prospect of shorter showers and less lush front lawns. As Jesse McKinley reported on the front page of Sunday’s New York Times, the twin calamity of recession and drought is hitting the Central Valley, the nation’s biggest agricultural engine, hard. Even as your income may be headed south, you’ll soon be paying more if you want almonds and avocados.

•

The once venerable San Francisco Chronicle may be the next casualty of the besieged newpaper industry. The paper lost more than $50 million in 2008 and is on pace to fare worse this year. Its owner, the Hearst Corporation, is demanding deeper cuts among an already downsized staff. If that doesn’t stem the tide of red ink, Hearst execs say, “we will have no choice but to quickly seek a buyer for The Chronicle, and, should a buyer not be found, to shut down the newspaper.” As with many others the publication’s reporting capacity has been shriveling as it struggles to survive the industry’s upheaval. But San Francisco without its oldest and largest newspaper? At the very least, another clarion call for digital journalism 3.0 to really get cranking.

Update: David Cay Johnston explains how the Chronicle, tellingly, failed to report adequately on its own serious situation.

Nothing to fear but everything itself?

With the stock market sitting at half the level it did a decade ago, and with new surveys showing carnage in consumer confidence and housing, I’m struck by the saturated language of the national nightmare. (It’s not just the apocalyptic headlines driving us to despair.) This story from the Associated Press today gathers the poetry of the pain — after its lead sentence announcing that American confidence went into “free fall” in February, the relatively short dispatch uses each of the following terms at least twice:

fear (2)

decline (2)

plummet (2)

plunge (2)

collapse (2)

severe (2)

slash (2)

shrinking (2)

battered (2)

suffer (3)

drop (4)

sink/sank (4)

worried (4)

low (6)

Superlative phrases in the story include “massive job cuts,” “driven to their lowest level ever” (consumer expectations) and “the largest drop in its 21-year history” (a national home price index).

Recently a friend sent me an email wondering why President Obama hasn’t done more to talk up confidence as he’s traveled around promoting his economic recovery plan. The answer probably lies most in the calculus of Capitol Hill, and the political pressure apparently needed to pass his legislative agenda. There’s also Obama’s admirable position that he won’t sugarcoat the truth about our troubles the way the administration before him did to such disastrous effect.

But it’s a daunting balancing act with perception at this point. You don’t have to be an economist to sense how the downward spiral of fear could itself become deeply damaging. (If it hasn’t already — as Robert Shiller warned in a recent column, a Great Depression narrative “could easily end up as a self-fulfilling prophecy.”) And Obama’s political opponents increasingly are able to agitate using raw emotional appeal: Last night CNN’s in-house ideologue Lou Dobbs hammered at Obama’s “fear mongering” and accused him of repeatedly talking down the markets and economy. In the New York Times today David Brooks feigns sympathy for the president while suggesting that Team Obama is in way over its head. (“I hope the president succeeds even though he probably won’t!” is the message.)

Many will be watching intently tonight when Obama addresses a joint session of Congress for the first time. The only positive polling in sight shows that he’s still got the thumbs-up on job approval from a decisive majority of the public. It’s a remarkable measure of confidence floating on a tide of ugly numbers — Americans believe Obama will sail us in the right direction, even with no horizon in view.

Comments (4)

Comments (4)

You must be logged in to post a comment.